Stolper -Samuelson Theorem

The Stolper-Samuelson Theorem was derived in 1941 by Paul Samuelson and Wolfgang Stolper and was largely based on the work of the Heckscher-Ohlin model. The theory is one of the best known and simplest theorems in trade theory. It hypothesises the relation between relative prices of output goods and relative factor rewards, specifically real wages and real returns to capital. Thus it states how given a rise in the price of a good, this causes an increased return to the largest factor of production and a subsequent fall in the return of other factors.(10)

The Stolper - Samuelson theorem was derived from the Heckscher- Ohlin model. The stolpper - Samuelsson theory is an idea in the trade theory. It describes the relationship that exists between relative prices of output and relative factor rewards. Most especially to real wages and real returns to capital. The theory states that under some economic assumptions constant returns, perfect competition - a rise in the relative price of a good will lead to arise in the return to that factor which is used the most intensively in the production of the good and conversely, to a fall in the return to the factor. It demonstrates how changes in output prices or the factors when positive production and zero economic profit are maintained in each industry (16) important role in analyzing the effect of factor income in two ways:

(I) When countries move from self sufficiency to free trade

(II) When tariffs or other government laws are levied within the Heckscher- Ohlin model.

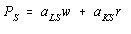

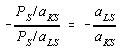

There is an assumption of perfect competition in all markets. If production occurs in an industry, then economic profit is driven to zero. The zero profit in each of the industries in the economy imply:

PSrefers to the price of steel and PC the price of clothing, w is the wage paid for labour and r is the rental rate on capital.

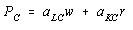

Also note that:

is the dollar payment to capital owners per ton of steel produced. The right-hand-side sum then is the dollars paid to all factors per ton of steel produced. However If the payments to factors for each ton produced equals the price per ton then profit must be zero in this industry (27 & 10).The same logic is used to justify the zero profit condition in the clothing industry.

In this case there is an assumption that firms treat prices exogenously since any one firm is way too small to alter the prices in the market. Since the factor output ratios are also fixed, wages and rentals remain as the two unknowns.

source: (27)

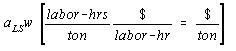

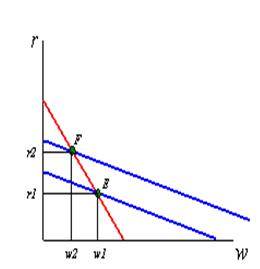

The set of all wage and rental rates which will generate zero profit in the steel industry at the price PSis the blue line. At wage and rental combinations above the line, as at points A and D, the per unit cost of production would exceed the price and profit would be negative. At wage-rental combinations below the line as at points B and C, the per unit cost of production would fall short of the price and profit would be positive. Notice that the slope of the flatter blue line is

Similarly the set of all wage-rental rate combinations which generate zero profit in the clothing industry at the given price PC is given by the red line. All wage-rental combinations above the line, for example at points B and D, generate negative profit, while wage-rental combinations below the line, for example at points A and C, generate positive profit. The slope of the red line is

The only wage-rental combination that can concurrently support zero profit in both industries is found at the point where two zero-profit lines meet- point E. This point represents the equilibrium wage and rental rates that would arise in a Heckscher- Ohlin model.

source: (27)

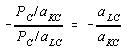

Lets, suppose there is an increase in the price of one of the goods. (steel), PS, rises. This could happen if a country moves from autarky to free trade, or, if a tariff is placed on imports of steel. The price increase will cause an outward parallel shift in the blue zero-profit line for steel as shown left. The equilibrium point will shift from E to F causing an increase in the equilibrium rental rate from r1 to r2, and a decrease in the equilibrium wage rate from w1 to w2. Only when there is a higher rental rate and lower wage can zero profit be maintained in both industries at the new set of prices. Using the slopes of the zero-profit lines we can show that

which means that clothing is labour intensive and steel on the other hand is capital intensive. Thus, when the price of steel rises, the reward to the factor used intensively in steel production (capital) rises that is interest rate rises, while the payment to the other factor (labour) falls, that is wages fall. source: (27)

The stolper samuelson has also been used to explain the political economy responses to a change in the countires open mindedness to trade as suggested by Rogowski when using an extende model with three factors, land, labour and capital. he used a wide range of historical evidence to illustrate how different factor endowments could explain country variations in impact of trade on nations.(13)